How To Spot a Text Scam

This article was written and provided by our partners at BECU.

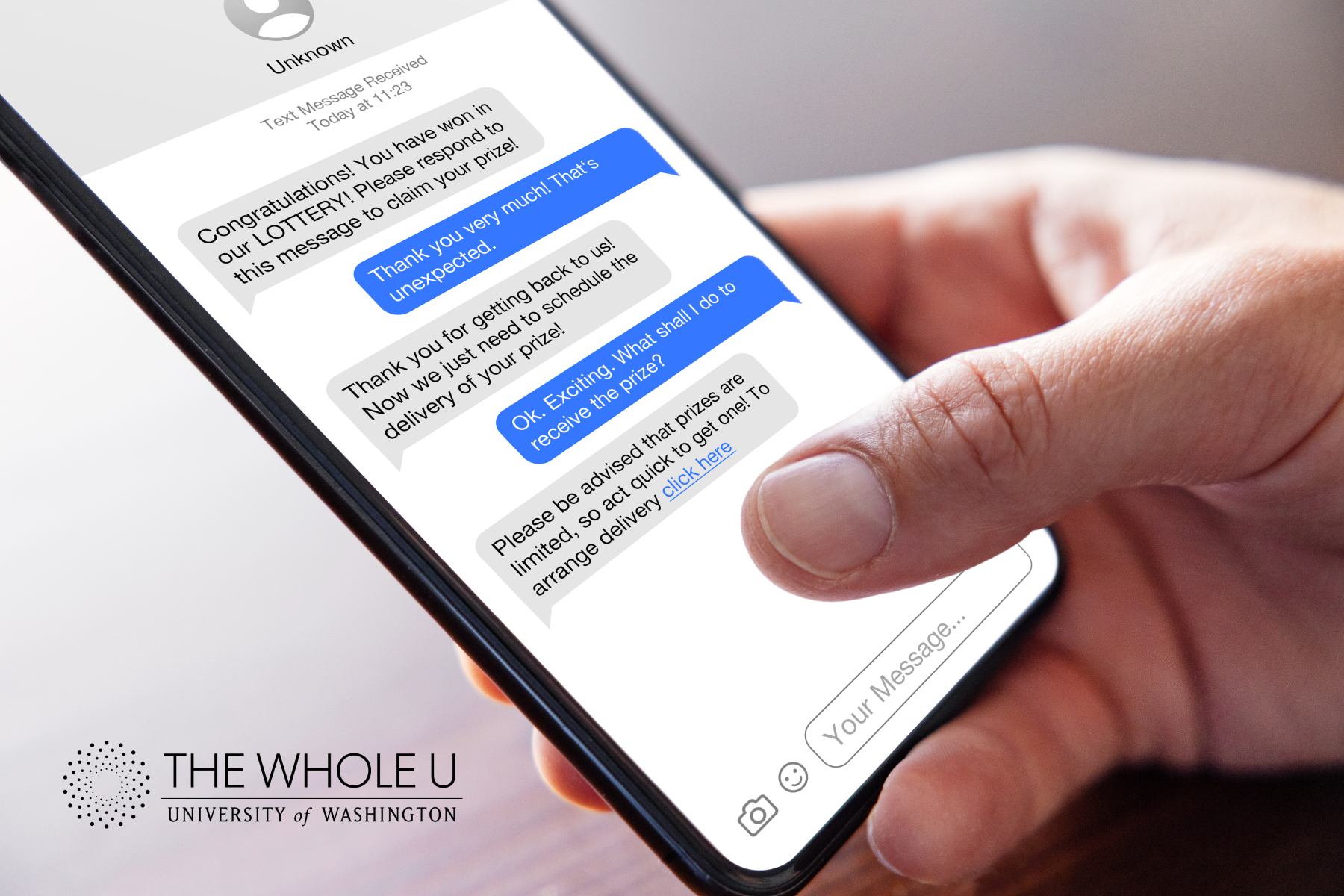

If you’re getting suspicious texts, you’re not alone. Scammers often impersonate people and organizations you trust. In this article, we identify common scams, ways to prevent fraud and how to spot fake texts.

Is that text a fake or the real thing? Don’t click on anything until you read this article.

Bank impersonations are among the most-reported text message scams, according to a June 2023 U.S. Federal Trade Commission (FTC) data analysis. These scams added up to a mind-boggling $330 million in losses for U.S. consumers in 2022.

Scams like these aren’t uncommon here in Washington state. Washington is second among all states where consumers reported scams in 2023. Top Washington scams reported include imposter scams and identity theft.

According to the FTC’s top scams of 2022, the biggest reported losses were via bank transfers, with $1.5 billion reported lost to scams of various types. And losses aren’t just among older adults, often targeted by scammers. Young adults aged 20-29 reported losing money more often.

Are Text Scams New?

Text scams aren’t new, but the tactics scammers use may be new to you. As consumers become savvy, fraudsters simply change tactics and tweak messaging. Attackers pretend to be institutions you trust, such as a bank or credit union. The scammers play on your emotions, creating a sense of urgency to pressure you into making a hasty reply.

“Scammers never take a holiday. In fact, they take advantage of holidays and certain seasonal events to prey on our better judgment,” said Sean Murphy, SVP and Chief Information Security Officer (CISO) at BECU.

During tax season, scammers may threaten you as fake IRS representatives. During the holidays, criminals might focus more on Amazon orders and USPS deliveries.

This may seem like a lot of work for little reward. But trying to defraud people is the criminal’s full-time job, and it only takes one success to drain a victim’s bank account.

For example, student loan repayment is restarting—so scammers are trying to convince people they’re calling from the Department of Education. The fake representatives claim they can help borrowers lower payments, avoid repayment or get loans forgiven altogether.

But the aim is the same. In short, getting you to provide payment for nonexistent services, personal information or your Federal Student Aid login information.

Text Scam Tactics

For its analysis, the FTC analyzed a random sample of 1,000 text messages reported to the FTC. Fake bank security messages were the top type reported, including messages impersonating real banks.

Typically, the text messages ask the text recipient to verify a large transaction by calling a phone number or clicking a link. Scammers can also achieve their goals by saying:

- Fraudulent activity has already taken place on your account.

- Asking you to verify a very large amount.

- Saying there’s a problem with your account.

This type of SMS phishing attempts to trick you into giving out personal information scammers can use to access your accounts.

“Fear is a motivator the scammers use to scare you into disclosing personal information—when normally, you would not,” Murphy said.

If the recipient responds, the recipient is connected to a fake representative or website. Websites could appear similar to your financial institution’s site—similar enough that when you use your username and password, the hackers can steal your login information. Other links could install an app on your phone that can steal personal or financial data.

What Text Scammers Want

If you’re asked to call a number or navigate to a website, an impersonator could try to get you to provide your:

- Bank account number.

- Social Security number.

- Credit card number.

- Bank login information.

- Banking information: How much money you make.

- Credit card information: How much you owe in debt.

Sometimes, scammers are looking for just bits of information they can assemble with other data they already have about you. They may also be able to sell the information.

Why Text Scams Want Your Information

With your account information, criminals could open an account with a stolen identity, withdraw money from your account, or make unauthorized purchases. Types of credit union fraud resulting from text scams could include:

- Debit card fraud: A criminal uses your debit card number or PIN to make unauthorized purchases or account withdrawals.

- Wire fraud: Scammers steal a person’s username and password and make an unauthorized wire transaction.

- Check fraud: Creating checks or check forgery by forging a signature and presenting it for cash.

Four Steps To Help Prevent Fraud

You can take some simple steps to help prevent fraud:

Review Your Statement

Your statement could contain charges or companies you don’t recognize, or charges made in locations you never visited. You might also see small charges, indicating someone is “testing” your debit or credit card before using it for a big buy.

Watch for Big Spends

If you see a significant drop in your available checking or savings balance online or a big bump in your credit card balance, contact your financial institution immediately to investigate.

Listen to the Emotional Tone

If a text, call, or email becomes threatening, angry, or aggressive, consider it a red flag. “Creating a false sense of emergency or wanting you to believe you are in trouble is a pretty sure sign that you are being scammed,” Murphy said.

Be Careful With Personal Questions

Check with your financial institution on how they will communicate with you. BECU doesn’t call, text or email to request sensitive personal information, such as your PIN or Online Banking password. If you get a call from someone claiming to be from BECU who asks you for this sensitive information, hang up immediately. Do not call the number back.

Murphy underscores this point to BECU members. “We do use text messages, but we want to make sure our members know what to expect,” he said. “If we reach out to you, we are not going to ask you to prove who you are. Sometimes, we may ask some personal security questions by phone, but only when you call us at our number, 800-233-2328.”

Help! I Fell for a Scam!

While taking precautions is helpful, text, phone and email scams are constantly evolving. It’s understandable if you accidentally fell for fraudulent tactics. But don’t panic—contact your financial institution as soon as possible.

If you have concerns about a suspicious communication you’ve received or responded to that claims to be from BECU, you can:

- Call BECU at 800-233-2328.

- Send BECU a secure message using Messenger in Online or Mobile Banking.

- Visit any BECU location.

Related Resources

- Social Engineering Scams: Protect yourself and use caution if you’re being urged to provide information immediately.

- Fraudsters Are Posing as BECU – What They’re Doing: Criminals are spoofing BECU and sending fake texts, learn how to protect your accounts.

- Identify Theft: If you suspect fraudulent activity on any of your BECU accounts—contact us right away.

One Thought on “How To Spot a Text Scam”

On November 26, 2023 at 7:42 AM, Credit Card Fraud said:

Thanks for your post.

Regain Funds LLC boasts a proven track record of successfully resolving financial disputes and recovering assets through a combination of legal and technological means.

Comments are closed.