Make financial resolutions you can stick to and learn the specific actions you can take to achieve each one from our partners at BECU.

Takeaways: Commit to your financial goals in 2026

- Start the new year off right by reviewing your income, expenses and debts, then budget and save for future spending goals.

- Big financial changes can come from small steps, such as automatic savings transfers or making a Financial Health Check appointment.

- Don’t discount or procrastinate on long-term planning, whether for your estate or a down payment on a home.

New Year’s resolutions often focus on physical health, but financial health is important, too.

Financial resolution essentials

Ideally, New Year’s financial resolutions focus on your desired goals and outcomes. Resolutions might include budgeting, saving for emergencies and reducing debt. The key to any resolution is making sure you can stick to it. An “approach-oriented” goal is more motivating and successful for resolution-makers than an avoidance-oriented goal, research shows.

Approach-oriented goals involve achieving desired goals and outcomes. An example of an approach-oriented goal would be: “This year, I’ll pay down my debts.”

Avoidance-oriented goals focus on avoiding undesirable outcomes. An avoidance-oriented goal might be: “This year I’ll stay out of debt.”

It’s all about framing.

With that in mind, we put together a list of approach-oriented financial New Year’s resolutions and actions that can help you improve your financial life. Work your way through our recommended personal finance actions, and by the end of the year, you’ll be closer to achieving your financial goals.

Start a budget (or fine-tune it)

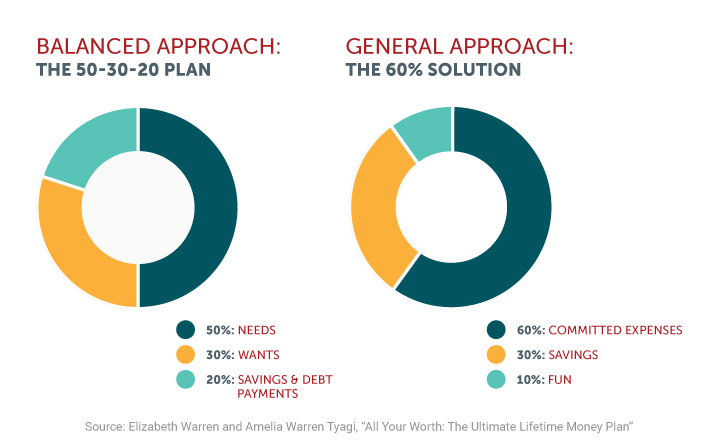

Maybe you prefer a general approach, like the 60% solution, where you reserve 60% of your money for committed expenses, 30% for savings and 10% for fun.

Or maybe the 50/30/20 budget plan is your style — 50% for needs, 30% for wants and 20% for savings and debt.

Remember that budgeting doesn’t have to be perfect, and you can change strategies if your chosen approach isn’t working for you.

Get started by understanding your spending habits. Look back at where you spent money the past few months and track your current spending with a spending journal. Compare your outgoing money to your income.

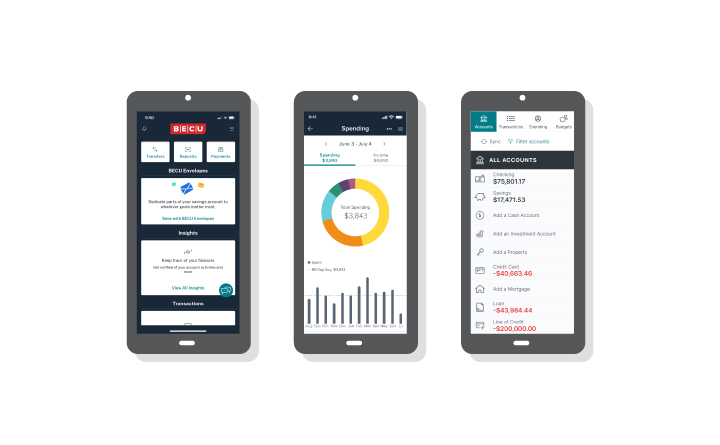

BECU’s Better Budgeting tool is one helpful resource.

Budgeting apps

Budgeting apps can help you track your spending and progress toward goals. The easy-to-use budgeting app Mint was discontinued — but BECU’s free Money Manager might be a great alternative. There are many others to choose from, as well.

Research what works for you. You want to end each month knowing where your money went, not surprised or overwhelmed when checking your account balances. Also, keep in mind, there are ways to budget while considering inflation.

Build your emergency fund

Your emergency fund helps when the unexpected happens — whether that’s new medical bills, fixing your car or being laid off. If you have a financial safety net, you won’t need to run up credit card debt and end up paying interest.

As a general rule of thumb, your emergency fund should contain three to six months’ worth of living expenses. Make sure you put your growing stash of cash in FDIC- or NCUA-insured savings accounts.

Set up an automatic savings transfer that sends cash to the account with every paycheck or once monthly. It’s okay to start small and increase amounts as you go.

BECU members can also explore Save-Up, the automated savings tool that lets you build savings by using your debit card.

Reduce your debt

Debt can affect your life in many ways, including whether you will be approved for a personal loan, credit card or mortgage, and the interest rate you will pay.

Paying interest monthly also depletes the cash for saving and spending on things you enjoy.

Add up your total debts, including:

- Credit cards

- Student loans

- Auto and other vehicle loans

- Mortgages and HELOCs

- Medical debt

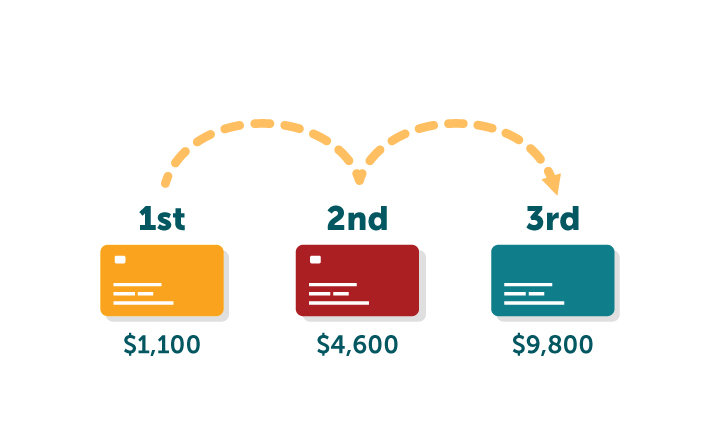

Review your total debt amount and investigate different methods for paying it down: debt snowball, debt avalanche or debt cascade. There isn’t a one-size-fits-all solution. Choose the strategy that best motivates you.

If you find it challenging to take this step, BECU members can make a free Financial Health Check appointment.

Save for your big 2026 expenses

Now’s the time to review significant expenses that happen every year. Instead of relying on credit when these expenses pop up, budget monthly in advance for big expenses.

Large annual expenses could include:

- Holidays

- Birthdays

- Vacations

- Taxes

- Insurance payments

- Donations

Review 2025’s expenses to get an idea of how much you might spend on the same expenses in 2026. Divide the estimated total by 12 to estimate a monthly saving target.

Consider opening a separate account to keep these funds secure and help avoid temptation. You can also categorize your savings with our digital tool, BECU Envelopes. Set up automatic transfers each month so you know the money will be here when you need it.

In addition to the next year, also estimate big purchases you plan to make in the next few years. These might include buying a car, having a baby, paying for college or relocating. Start saving for these expenses now.

When it comes to stashing these funds, compare different savings options, focusing on their interest rates to determine the best way to grow your money. For example, a certificate of deposit typically offers a higher interest rate than a savings account, but requires you to lock in your cash for a set period of time.

Find better interest rates on credit cards and loans

Interest rates, in general, have been climbing, so the new year is a good time to review rates. You may be paying too much for your borrowed money, particularly if you haven’t checked APRs in a while.

Credit unions generally offer interest rates that are low compared to bank national averages.

You can also look into consolidating your debts with a lower-interest personal loan or find a credit card with more competitive rates — but do so with caution. Debt consolidation can seem like an easy fix, but if you don’t make changes to your spending and saving habits, it could end up causing more harm than good.

So, make sure you’ve addressed the behaviors that got you into debt in the first place and that you can cover all of your expenses without adding more debt.

For homeowners, if you purchased your home with a higher rate, refinancing may provide a great opportunity to benefit from a lower mortgage interest rate and save you money over the long term. Be sure to weigh the pros and cons, however, as refinancing can also come with upfront costs.

Improve your credit score

The first step to improving your credit score is checking your score. An excellent credit score can help you get better rates on loans.

Credit card companies, lenders and financial institutions often share credit scores with their customers. BECU members, for example, can check their FICO credit scores for free by logging into their accounts online.

Checking your credit score once a month or so is a good idea — as is understanding why your score might go up or why your score might drop. Different factors influence your ever-changing credit score.

Watching your credit score change and improve can encourage your efforts, and checking your own credit score or credit report doesn’t lower your credit score. Although they don’t provide a free credit score, you can use annualcreditreport.com to get your credit reports for free.

- Make on-time payments

- Reduce credit card balances

- Limit new credit accounts

Update your retirement plan

Are you on track for retirement? Total your retirement balances in IRAs, 401(k)s, projected Social Security benefits and pension funds. You can use free online retirement planning tools like the U.S. Department of Labor’s worksheet, which estimates how much you should save.

For a more thorough check-up, consider making an appointment with a personal financial advisor to review your retirement strategy. Your advisor can help you on what’s new in 2026 and share new ways to save as you age.

For example, those 50 and older can put extra money into retirement through catch-up contributions.

Plan for a future home purchase or remodel

Whether you want a new house or just a new kitchen, you likely know that home purchases and updates are expensive. With some planning, you can take advantage of tax deductions, government programs and better interest rates.

If it’s your first time buying a home, research any first-time homebuyer programs available to you and compare requirements and costs.

If you’re considering using a home equity loan or personal line of credit to pay for these updates, make sure to compare loan features, rates and terms when choosing the best option.

Overall, credit unions may offer lower interest rates than the national average for banks on home mortgage refinancing, HELOCs, and home improvement loans.

Start or update your estate plan

Your estate is the property you leave behind after passing away. You don’t have to be wealthy to have an estate. It can simply be what’s in your checking, CD and savings accounts, or any retirement or pension accounts.

List and review your accounts as a first step. Check who the beneficiaries are on each account — the people you’ve named to receive your account funds after you pass away. This is a good idea especially if you’ve encountered any big life changes in the past year such as a marriage, birth, death or divorce.

You may need to complete paperwork or an online form to update the recipients.

If you’re ready to learn more, start delving into estate planning with a professional — including how wills and trusts work.

Review your insurance costs and coverage

Review your current insurance, including your coverage, premiums and deductions and shop around to see if there’s a better deal. Depending on your situation, this might include:

- Auto insurance

- Homeowners insurance

- Renters insurance

- Small business insurance

- Health insurance

- Life insurance

Set aside time for online research or call an independent agent (who has access to multiple plans) to investigate alternatives. You may find that you are over-insured, underinsured or are paying too much for what you’re getting in return.

For example, you may be able to reduce your auto insurance premium by increasing your deductible. Just make sure you are prepared to pay a larger out-of-pocket expense if you have a claim.

You can also inquire about other discounts, such as a lower cost for paying your premium in one lump sum instead of monthly, a safe driver discount, or pay-per-mile discounts that charge based on the number of miles driven.

With any independent agents you engage with, make sure to take steps to verify their credentials, research their public reviews and understand how they’re compensated. For example, do they charge a fee, or are they paid by insurance providers?

Increase your financial account security

Your hard-earned cash deserves a safe home. Fraud, scams and hacks can all drain your bank accounts.

Review your logins and change passwords if you haven’t done so during the last six months. Be sure not to share logins and passwords with others, and stay ahead of any text scams and phishing attempts.

Plan for next year

Once you’ve taken steps to follow through on your financial New Year’s resolutions, it’s time to celebrate — then start the planning process for next year. Note anything you postponed or procrastinated on this year and make sure to include them in your future planning.

Also note items you found difficult to achieve: What were the barriers, and what might you do differently next year?

For example, you might note that you rushed to make year-end donations and struggled to come up with the funds this year. Moving forward, you can set up automatic, monthly donations and alleviate last-minute stress.

With a little practice and consistent effort, you’ll have stronger money muscles and come closer to achieving your goals.

These tips are shared by BECU and are intended for general financial education. For personalized advice, consult a qualified financial professional.

BECU Lead Financial Educator

Stacey Black, BECU’s lead financial educator, has worked for BECU for nearly 30 years. She provides financial education to people of all ages and backgrounds, with thousands having attended her webinars, seminars, in-person classes and presentations at Financial Reality Fairs.

Through the BECU Blog, Stacey shares her knowledge on saving, debt reduction, building credit and overcoming financial challenges.

Written by

Written by